Home > PPA News & Blog > Queensland’s Rise in Land Tax >

Queensland’s Rise in Land Tax

One of the common considerations when purchasing an investment property is the land tax liability that comes along with it.

One of the common considerations when purchasing an investment property is the land tax liability that comes along with it. Unlike Stamp Duty, which is paid once at settlement when purchasing a property, Land Tax is an ongoing tax levied each year by the state government of where your asset is based.#nbsp;

Effective on June 30 2023, the Queensland Government is changing the way it calculates Land Tax. From this date, they will use the aggregate value of all non-exempt Australian land owned by an entity to establish the rate of tax to apply to non-exempt land in Queensland.#nbsp;

This adjusted rate, will be applied to your Queensland land value to determine your land tax.

The assessment does not include exempt land such as the land under a Principal Place of Residence (up to 2 hectares is generally exempt), and initially will only apply to land held in the same entity as the Queensland holdings.#nbsp;

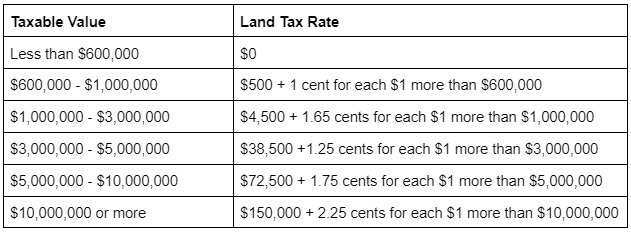

Although this change will impact current properties owned and future acquisitions, there are general exceptions to the rule, such as the land tax threshold. The current land tax threshold in Queensland is $600,000 (under the new legislation it will remain unchanged), meaning that if you own individual or multiple properties in Queensland, land tax is only payable if the combined statutory value of those holdings is above $600,000. However, under the new legislation, land tax will be payable if the total statutory value of all Australian land exceeds the $600,000 threshold. Below is an overview of the land tax rates in the state.

Example 1#nbsp;

To best explain how this land tax change will affect investors with diverse portfolios (after June 30, 2023), take into consideration the following example:#nbsp;

James owns land in Queensland worth $590,000 and has recently purchased land in Victoria valued at $410,000, both properties are owned in his personal name.#nbsp;

Example 2.1 – Australian Land Holdings

Currently, James would not have a land tax liability in Queensland as he is under the threshold.#nbsp;

However, as of 1 July 2023,#nbsp; James will be assessed on the total taxable value of land ($1,000,000) he owns across Australia. Noting both properties are investments, not principal place of residence.

Therefore, his Queensland land tax liability will be calculated as follows:#nbsp;

= $500 + (1 cents x 400,000)#nbsp;

= $500 + $4000

= $4,500

This amount will be multiplied to the QLD portion/percentage of James’ land to determine the final tax value.#nbsp;

= $600,000 ÷ $1,000,000#nbsp;

= 0.6 x 4,500

= $2,700

The new laws would mean that James would be paying an additional $2,700 than he would, when just paying tax for his Queesland land.#nbsp;

He would also need to pay $575 in Victorian land tax on the portion of Victorian land owned over the threshold (currently $300,000 at the time of writing).

Example 2 ($5m Portfolio)

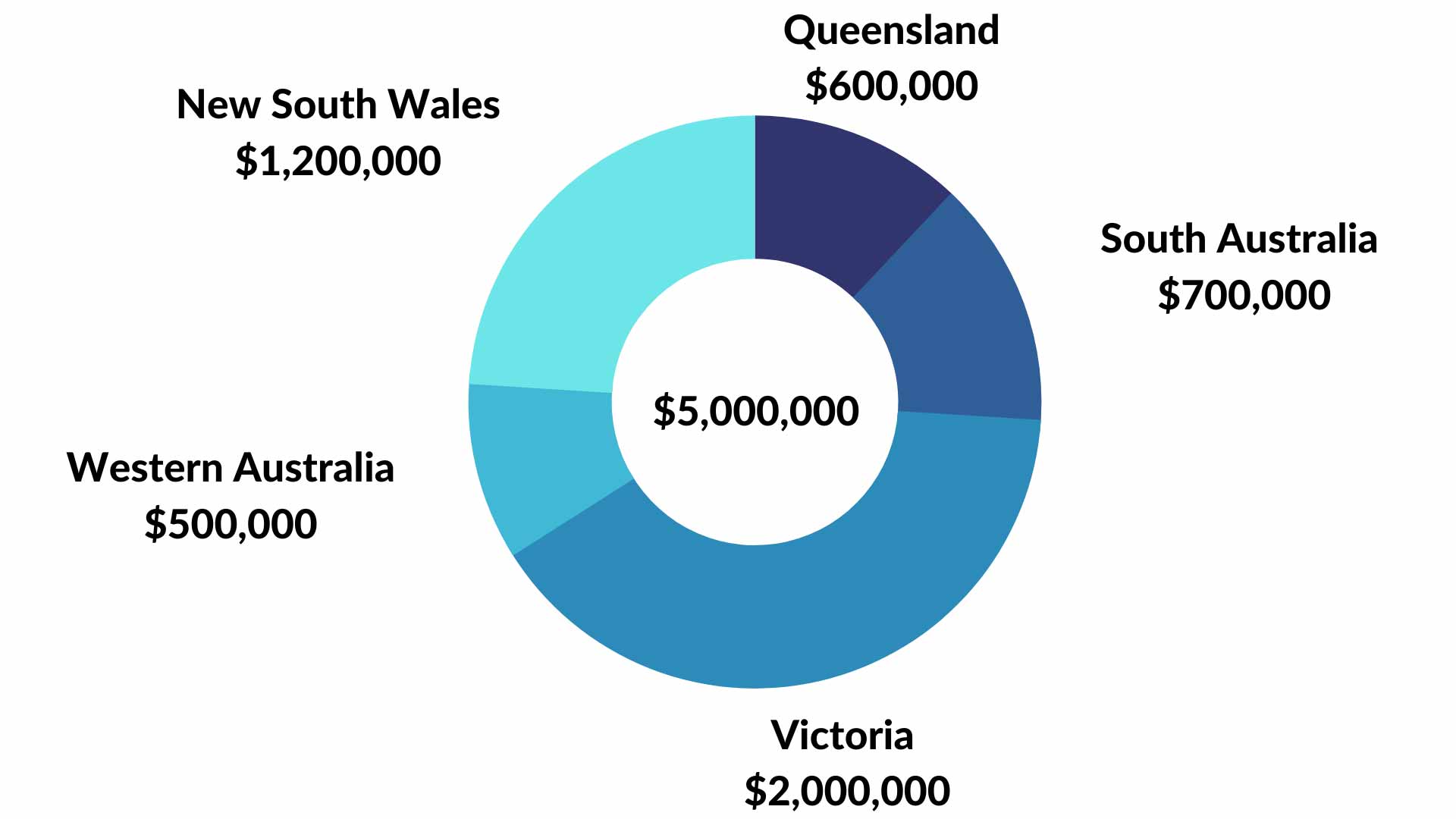

To better illustrate what this would look like for the majority of our clients with a diversified portfolio, we have prepared the following example comparison based on a portfolio with $5m of taxable investment landholdings.#nbsp;

Refer to example 2.1 to get an overview of the Australian land holdings for this portfolio.

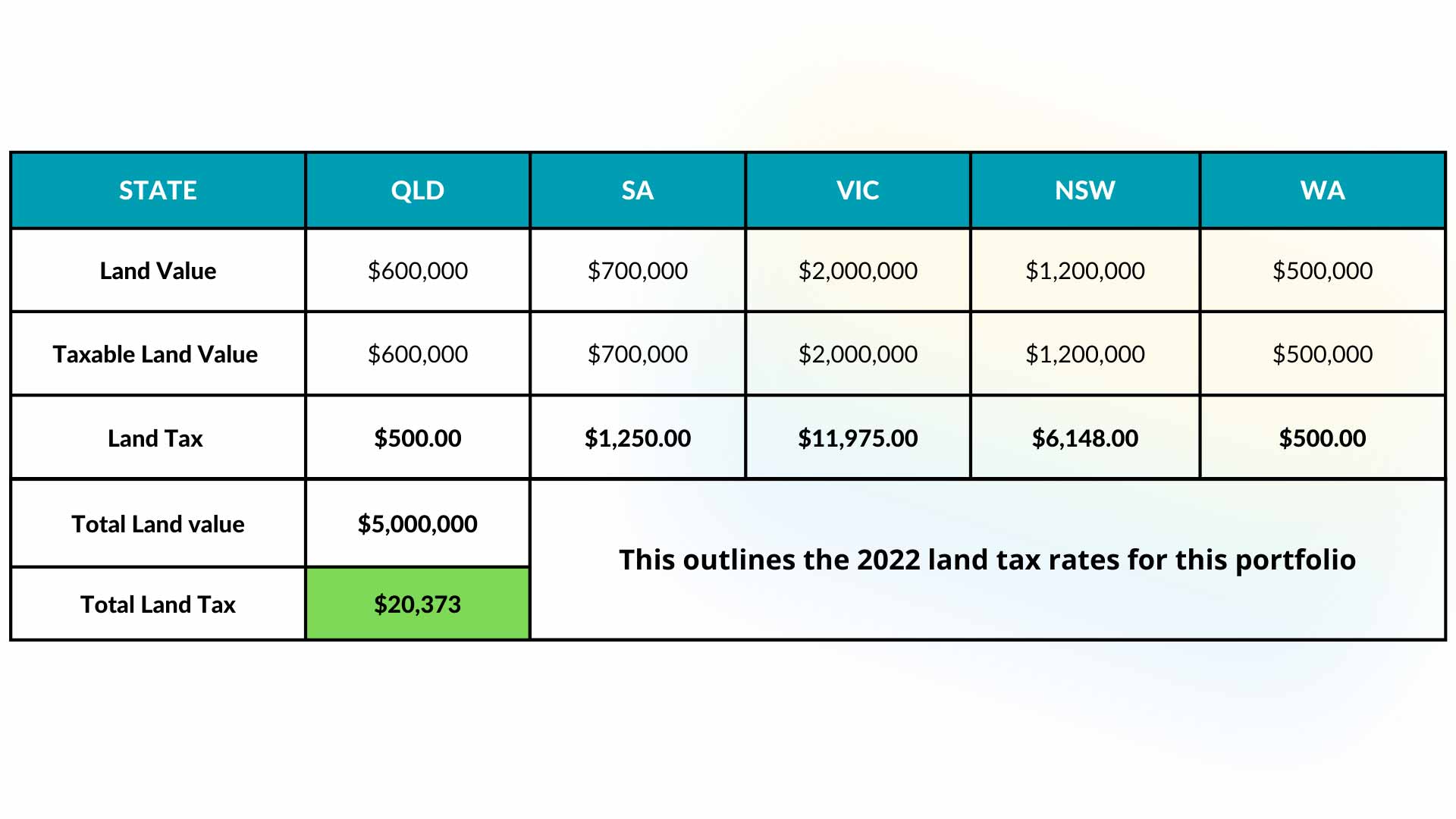

Example 2.2 – 2022 Land Tax Liability on a portfolio with $5m Land Value

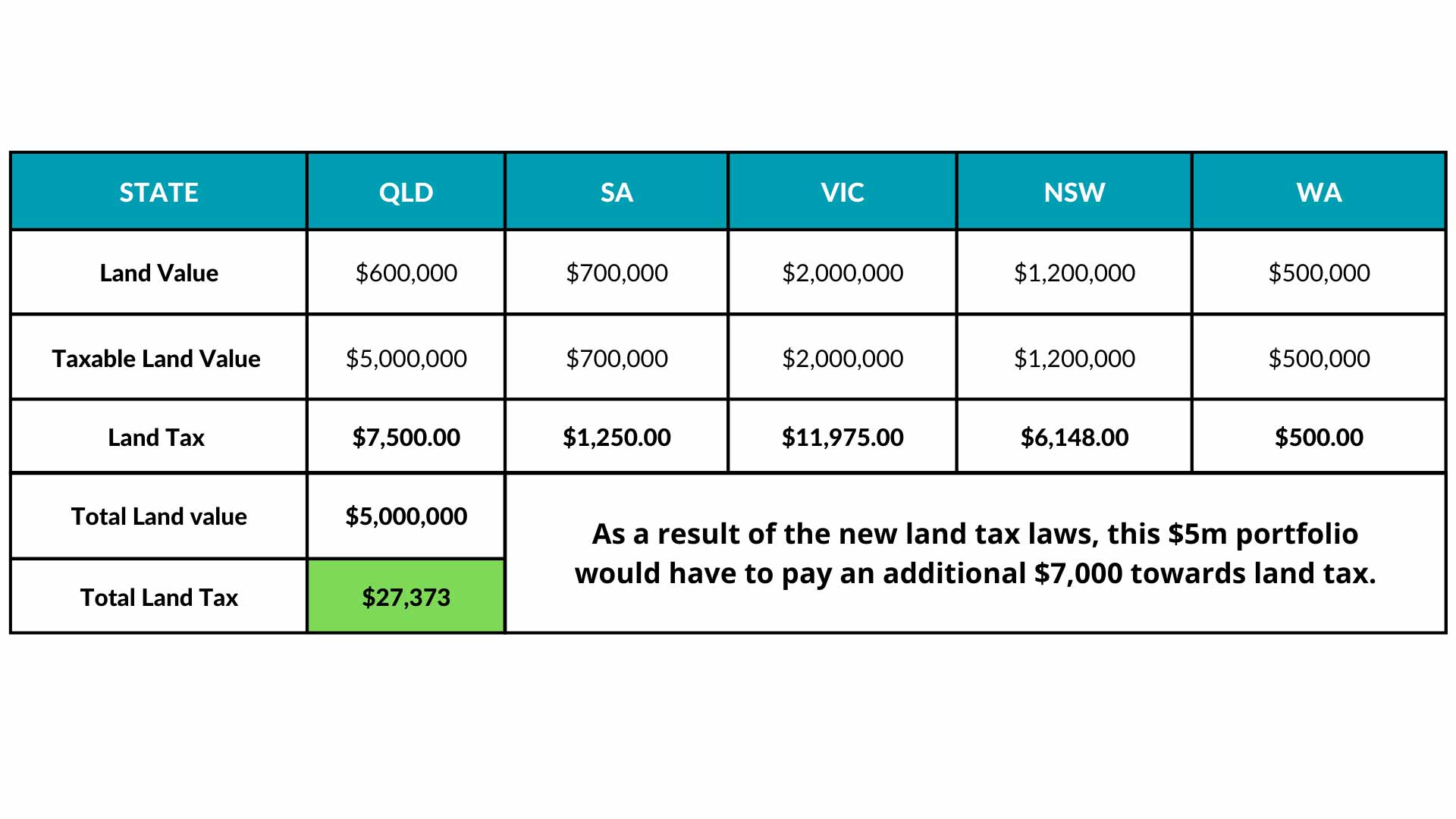

Example 2.3 – 2023 Land Tax Liability on a portfolio with $5m Land Value

Impact

The inclusion of interstate land when calculating land tax inevitably creates issues for entities with large property portfolios that include a QLD asset. The increased costs due to the updated land tax regime will deter investors, as it can result in assets being negatively geared, affecting the cash flow of the property. In addition, the lack of uniformity between the other states and territories and their jurisdictions on land tax would mean that the Queensland Government would have to make considerable changes to the existing laws, in order to make the proposed amendments work fluidly.#nbsp;

While the changes have been said to be placed to avoid ‘loopholes’ in the State’s land tax laws, it undoubtedly seems to be a ploy for investors to pay heavier tax. The obvious answer to avoid paying any tax at all, is to purchase properties outside Queensland where land values remain under the various state thresholds. However, those wanting to build out a large portfolio may find this a difficult roadblock, especially if other states or territories follow suit.

Looking Ahead

Rents are already increasing due to rising interest rates and record low vacancies. With the Queensland Government increasing their land tax for investors, we expect to see landlords increasing rents even further across their portfolios in Queensland and other states to offset the increased running costs. A question we are commonly getting asked from clients with properties in Queensland is, should I sell? From an investment standpoint, if the income and capital growth generated from Queensland assets continue to increase, then the increased land tax alone is unlikely to be reason enough to sell. This is especially true for clients in higher income tax brackets as they will likely be able to claim a tax deduction in their tax return.

Although these rules wont come into effect until mid 2023, we recommend you take into consideration the implications that you may have when acquiring an asset in QLD or if you already currently own land in the state, as part of a bigger portfolio.

Performance Property Position

The information in this article is general and does not take individual circumstances into account. Our position is that every client needs to review how this decision will affect them based on their portfolio and their individual situation. We caution anyone looking to sell as the property value could rise quicker than the increased land tax liability.

If you own investment properties in Queensland, you should organise a time to meet with a Performance Property advisor and have your portfolio reviewed or any potential future acquisitions assessed. There are strategic ways to work around this issue as opposed to making an impulse decision to sell. Speaking with your accountant regarding the structuring of your portfolio and tax is also essential to ensure that you can continue to make informed investment decisions based on your personal circumstances.

References

QLD government website: https://www.qld.gov.au/environment/land/tax/interstate#:~:text=The%20current%20tax%2Dfree%20thresholds,taxing%20your%20land%20outside%20Queensland).