Property Portfolio Management

Managing diverse property portfolios, spanning residential, commercial, and industrial property.

We manage portfolio risk

Investing in property is not just about buying well. It is about having an effective overall strategy and regular portfolio reviews, ensuring your property is consistently performing and your plans for financial independence remain on track.

Establishing and managing an extensive property portfolio provides a unique set of challenges and risks. There are variables such as rents, values, market conditions, market forecasts, interest rates and your personal financial situation which need to be considered. The complexity intensifies with the growth of assets within a portfolio. Without proper management, the risks can escalate rapidly.

Our Property Portfolio Management service is designed to simplify this process, empowering clients to effectively navigate challenges and mitigate portfolio risks. Our expertise extends to both portfolio and project management, ensuring a comprehensive approach that aligns with your unique needs.

Portfolio review

A specialised portfolio review includes two formal meetings per year, with three distinct objectives for each session.

Review Risk

Factoring in monthly changes and setting appropriate tolerance levels is critical to managing the risk of a large portfolio. Tolerance levels will change the closer you are to retirement.

Review Performance

We review the performance of the portfolio to ensure you stay on track. If there is a lag, we pinpoint underperforming within the portfolio and provide recommendations for improvement.

Action Planning

Analysing risk and performance results in the creation of an action plan, with a new plan devised every six months. Recommendations may include selling assets, undertaking renovations, acquiring additional assets, or a combination of these strategies. Our advice is substantiated by our research program, aiming to manage your risks effectively and keep you on the optimal path to attain your desired outcomes.

Minimising your risk

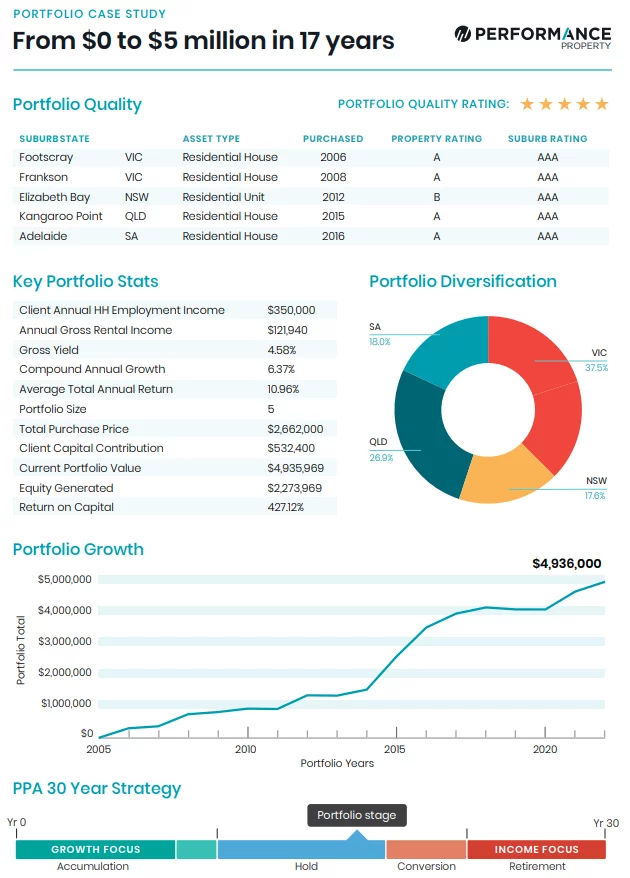

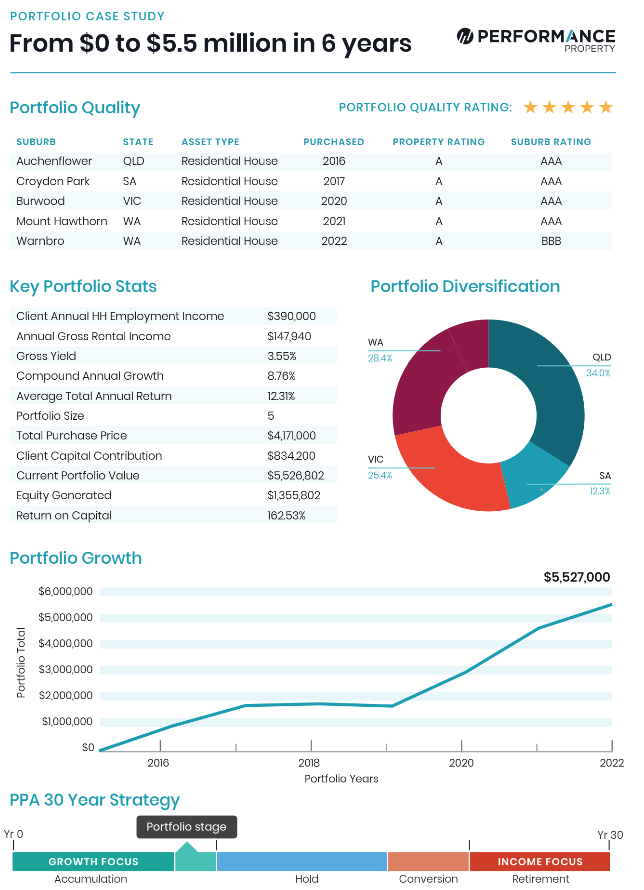

To minimise risk we have five key strategies include:

- Buy high quality assets below or in line with the median value for the area;

- Buy assets with scarcity;

- Buy assets in line with a formal due diligence process;

- Diversify asset types and price points; and

- Diversify geographic locations.

Increasing your overall return

To increase your overall return, our key strategies include:

- Invest in markets that are showing value;

- Invest in markets that are in or moving into an undersupply;

- Invest in different states to minimise land tax liabilities; and

- Sell assets in markets that are likely to fall or stagnate for an extended period.