Home > PPA News & Blog > Key steps in building a 10m portfolio >

Key steps in building a 10m portfolio

After 20 years in the property industry and seeing a wide variety of property portfolios, I wanted to provide the essence of what we believe to [...]

After 20 years in the property industry and seeing a wide variety of property portfolios, we wanted to provide the essence of what we believe to be the perfect $10m property portfolio and some insight on how to build it. It’s important to acknowledge, this is not a financial plan and this strategy is only available to sophisticated investors who meet the “sophisticated investor” definition under the corporations act.

Firstly, why $10m? Well, it’s a nice number and for most, it will represent absolute financial security & independence, without compromise. This number, however, is entirely your choice and you should be working backwards from the income you want to receive from your property portfolio. In the basic portfolio we outline below we are able to generate a relatively low risk 5% net return across the portfolio.

The time frame: Unless you have money coming in from a business sale or come into money from an inheritance, this process will take some time. In most cases for medium to high income households between the $300,000 – $600,000 bracket, this process will take 20+ years, depending on market performance, your personal expenses and current financial situation. For those marking around $1,000,000 or more we can speed it up, however you still need sufficient time in the market to allow the investments to mature and for you to pay down debt.

In my experience you rarely see anyone achieving a portfolio of around $10m without relatively high household income $350,000+. So this strategy has been designed for high income earners who want to grow an effective property portfolio passively, in a low risk framework. There are of course ways to grow a portfolio faster, such as using property development strategies however this carries a commensurate amount of risk and a substantial increase in time.

Like all the property portfolios we build, the core principles are the same: Buy property when it shows value, buy quality property and diversify.

There are 4 key phases to this process:

Step 1. Buy quality residential growth assets: The first step is to establish your asset base by buying quality residential assets in capital cities or major regional towns when these cities or towns are in the value stages of their respective cycles. Most clients in this strategy will end up buying 6 – 7 assets and then sell 2 or 3. The reason for selling some assets is to use the capital growth proceeds to aggressively pay down your Principal Place of Residence (PPOR) debt. In order to do this effectively you have to choose the right: market, suburb & asset and wait patiently for the market to run through its growth cycles. Entry price and due diligence is also critical.

Step 2. Pay off your mortgage: One of the keys to paying off your mortgage is to not take on too much debt to begin with. We target debt to income ratios under 3 times for our clients PPOR mortgages. Meaning that if you make $500k your home PPOR debt should not be more than $1.5m. This will allow you to pay your mortgage, save, invest and still have a lifestyle. Aggressively paying off your mortgage is a combination of asset sales from “step 1” and making additional repayments as you should have the capacity to do so if your PPOR debt to income is under 3.

Step 3. Use property equity: Once the PPOR is close to being paid off and you have equity across your portfolio, you can use lines of credit to buy low risk, high income commercial property. Effectively what you are trying to do here is pick up the spread between the investments net yield and the cost of borrowing. For example, the current cost of debt is approx. 2.5%, you should be able to pick up a “net yield” in our cash flow fund of 6.5%. If you had $1m invested, that would be net profit of $40k pa. There will also be capital growth, but this comes secondary to stable and low risk income. Importantly with this strategy we are always diversified across different assets all with quality AAA long term tenants.

Step 4. aggressively pay down debt: With your mortgage paid and the surplus income from Step 3. you should be able to use this combined income as a fire hose on your property portfolio debt. Through this process of paying down debt, your entire property portfolio will become cash positive and then it’s fairly smooth sailing until you have a zero debt position across the entire portfolio. This process of eliminating debt across the portfolio will take approximately 8 – 15 years pending the size of your household income.

This strategy has maximum effectiveness with time, as you need to allow the growth assets in step 1 to mature. If you buy at the correct time in the cycle, it should take around 6 – 9 years per asset to reach maturity. And obviously, as you don’t buy all the properties in year 1, so step 1 for most people can take anywhere from 10 – 20 years.

Steps 1 and 2 are the most difficult part to master. This is where your mortgage is at its highest, your income is still in the building phase, and many question the strategy because you won’t see immediate results. Most don’t have the discipline and/or the will power to stay with it. Compounding this, most people also don’t set up steps 1 and 2 correctly – buying incorrect assets or taking on too much PPOR debt relative to household income. And this is why just being a high income earner isn’t enough to make this work and why very few people get to a property portfolio of this size.

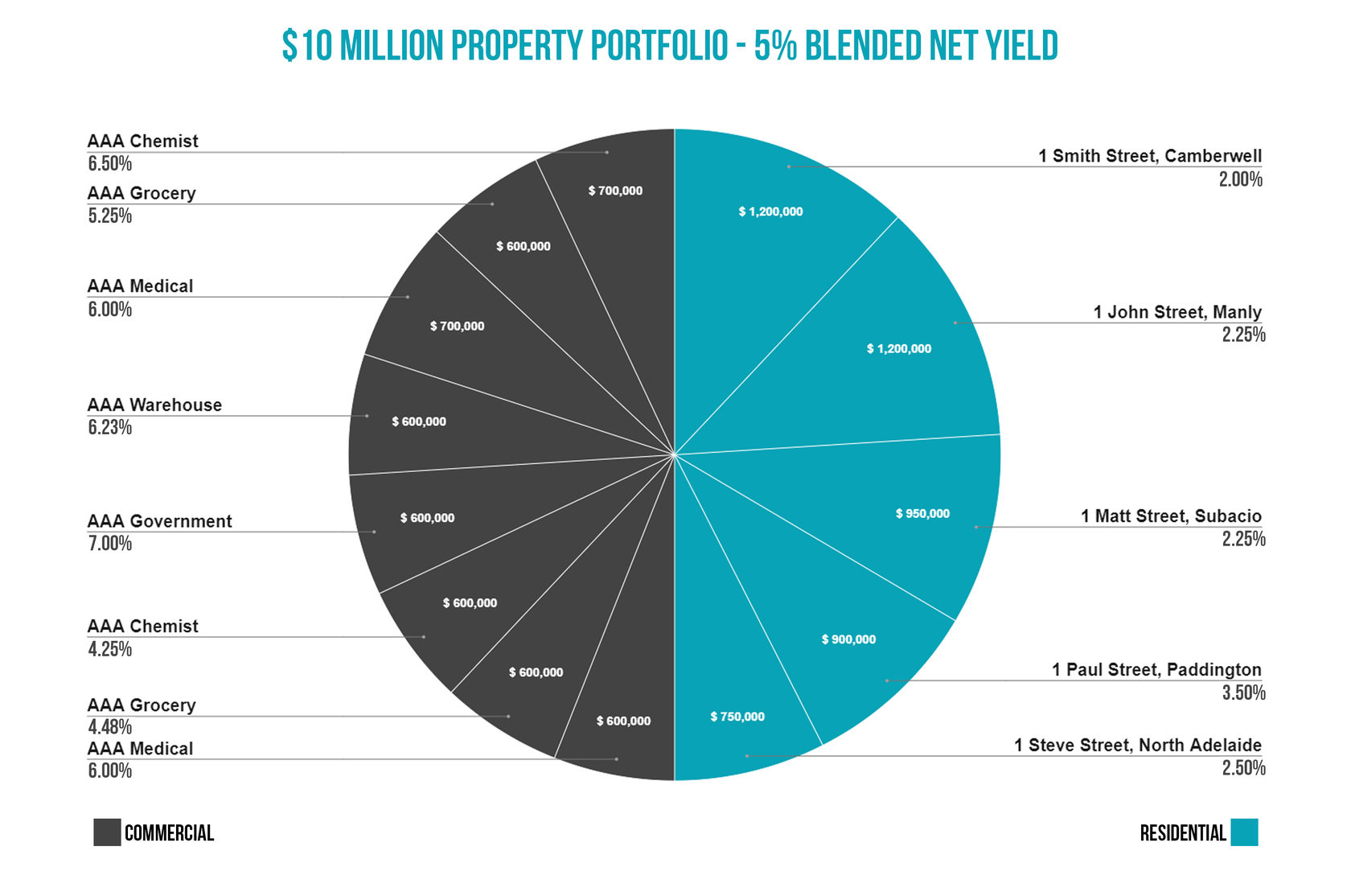

Please see an example below of what a completed property portfolio looks like:

PPA graph yield

A final word on diversification. Key to a low risk portfolio is the consistency of income despite all adverse circumstances. This would include extreme circumstances such as the current COVID 19 pandemic. As you can see this portfolio has 10 different income streams, roughly 50% coming from residential and 50% coming from commercial. Commercial is essential as the high net yields balance out the low net yields from the quality residential properties. But our focus when buying commercial assets is long term tenants that will still pay rent in economic contractions – such as government tenants, medical centres, hospitals, grocery or blue chip key supply chain businesses.

Economic contractions should be expected, recently in Australia they have occurred in 1972, 1982, 1989, 2001, 2007, and now 2020. Roughly happening every 10 years. These economic contractions have always been felt differently across the country and as such geographic diversification ensures that if some rents fall, others across the country may rise. Furthermore, if you need to sell it allows you to exit the assets where the market is performing well and use the proceeds to create cash flow stability within the portfolio. This is most important in the building phases of step 1 and 2, when you will be carrying high amounts of debt.

Lastly land tax. This tax you can’t avoid if you want to have a $10m portfolio, however, you can minimise it quite significantly through diversification. At a $10m portfolio value, your land value would be approximately $6m. If you have your entire portfolio in Victoria and its was exclusively residential, for example, your land tax bill would be approximately $90,000 per annum. If we diversify across the states and across residential and commercial most people can reduce this bill down to under $7,500 per annum. Reducing your land tax bill is especially important in steps 1 and 2 where every dollar makes a big difference. Having a quality accountant with experience in property investment is crucial for the tax guidance around this.

There is obviously much more detail, but these are the broad strokes that you need to be aware of.

We have over 20 years experience building these for ourselves and our clients Australia wide.