Investment options

We build and manage diversified property portfolios for investors. Our portfolios suit a range of circumstances and goals

Where are you at in your Property Portfolio Strategy?

If you’re seeking to grow your portfolio, our team is dedicated to assisting you in creating a customised property strategy that aligns with your wealth-building aspirations. Find out where your portfolio is at by booking a portfolio review with one of our PIPA Qualified Property Investment Advisors.

Performance model portfolios

Our investment committee has designed and approved a number of model portfolios that can be customised to meet the needs of our clients.

The purpose of these portfolios is to create over $2.5m of equity (not just value) which can be converted into an income stream for retirement.

Our property advisors have been trained on how to build these portfolios and can work with you to discuss your individual situation and suitability.

$2.5m

Property Investment Portfolio

ELIGIBILITY:

$250k Annual Income

$1.5m Equity or Net Assets

>20 Year Investment Horizon

$25,000 Annual Contribution

$5m

Property Investment Portfolio

ELIGIBILITY:

$400k Annual Income

$2.5m Principal Home Equity

>20 Year Investment Horizon

$40,000 Annual Contribution

$10m

Property Investment Portfolio

ELIGIBILITY:

$600k Annual Income

$4m Principal Home Equity

>20 Year Investment Horizon

$60,000 Annual Contribution

$20m

Property Investment Portfolio

ELIGIBILITY:

$1m Annual Income

$6.5m Principal Home Equity

>20 Year Investment Horizon

$100,000 Annual Contribution

Entry level investment programs

In addition to our Performance Model Portfolios, below are our entry level programs to help clients purchase and pay off their principal homes so they can build equity.

Principal Home Deposit Saver

ELIGIBILITY:

$250k Annual Income

>5 Year Investment Horizon

Principal Home Debt Reducer

ELIGIBILITY:

$250k Annual Income

>5 Year Investment Horizon

A complete range of property investment options

While our advice to every client is unique and based on their individual circumstances, below are some example investment options that we consider when compiling a portfolio for our clients.

ELIGIBILITY:

Open to sophisticated and wholesale investors

Minimum $250k annual household income

Over $2.5m in equity or net assets.

ELIGIBILITY:

Open to all investors

Minimum $300k annual household income

Finance pre-approval.

TYPES OF ACQUISITIONS:

Medical practices and medical centres

National offices and relocations

National Retail outlets, big box stores and warehouses

Industrial Factories.

ELIGIBILITY:

Open to all investors and homebuyers

Minimum $150k annual household income

Finance pre-approval.

Access our success stories of real clients, real results.

View a selection of case studies on client portfolios that we have built over the years.

Our results speak for themselves.

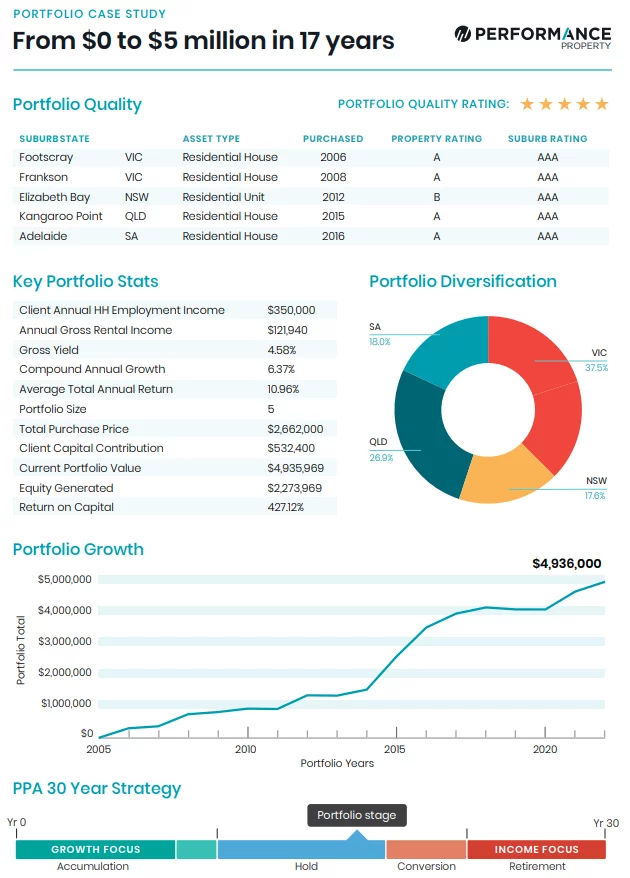

From $0 to $5 million in 17 years

This residential portfolio comprises four A-Grade established homes and a holiday apartment purchased in AAA locations between 2006 and 2016. The portfolio is diversified across

...

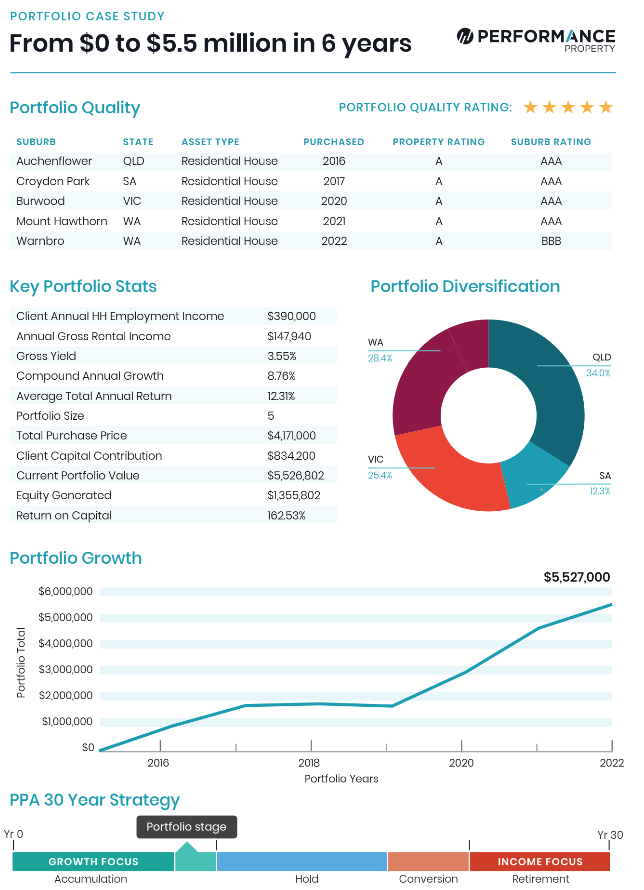

From $0 to $5.5 million in 6 years

This residential portfolio comprises five passive A-Grade established homes purchased in AAA and BBB locations between 2016 and 2022. The portfolio is diversified across four

...

From $0 to $6 million in 5 years

This residential portfolio comprises four A-Grade established homes purchased in AAA locations between 2017 and 2021. The portfolio is diversified across three states which helps

...

From $0 to $4.8 million in 8 years

Achieving over 400% return on our client’s invested capital. This simple residential portfolio comprises three A-Grade established homes purchased in AAA locations between 2013 and

...

From $0 to $4.4 million in 8 years

We started compiling this Capital City focussed blue chip residential portfolio for our client in 2014. The portfolio comprises four A-Grade established homes purchased in

...

From $0 to $7 million in 6 years

We are working with our client to build out a $20m portfolio. The portfolio currently consists of a unit block in Melbourne and three A-grade

...Our results speak for themselves.

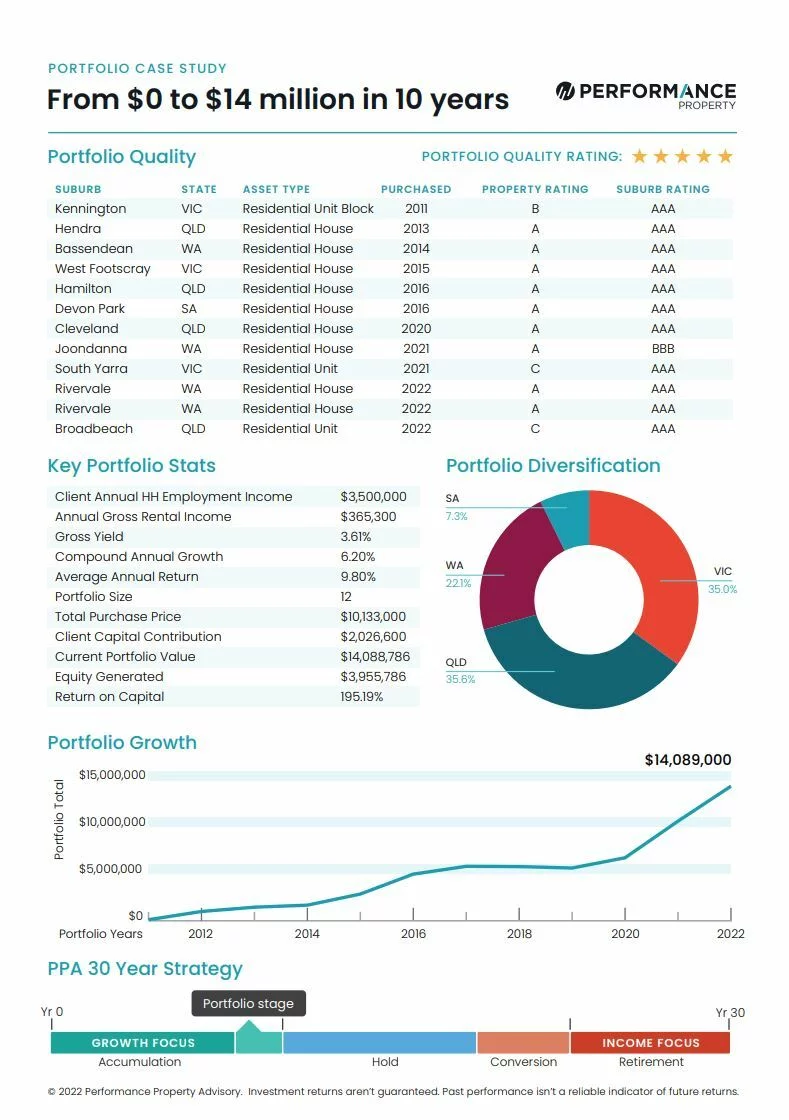

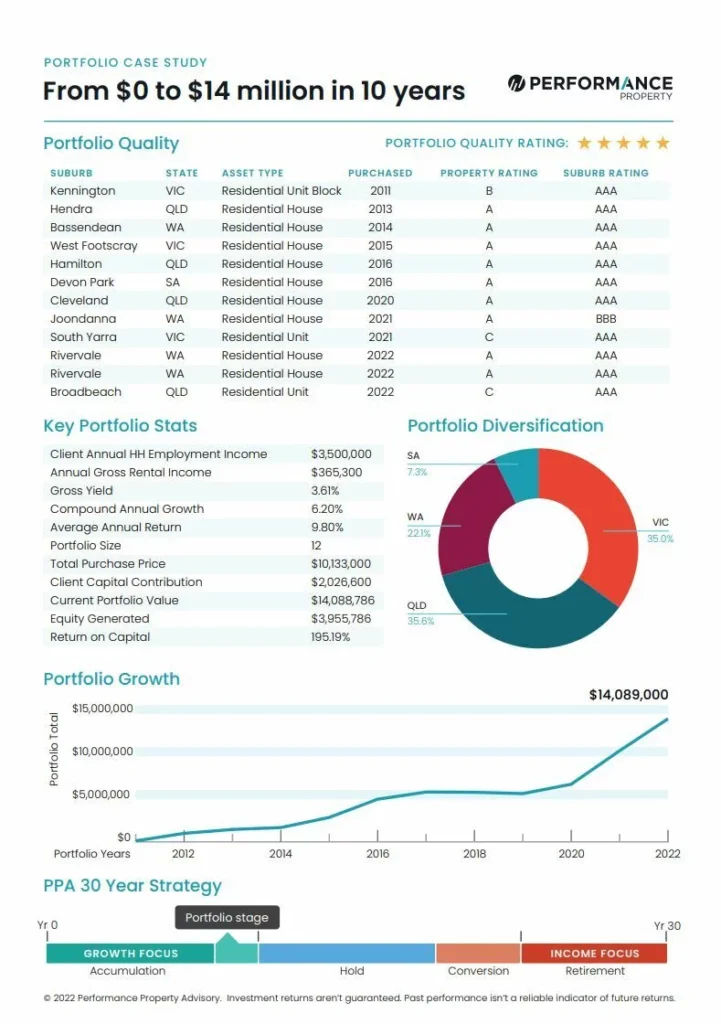

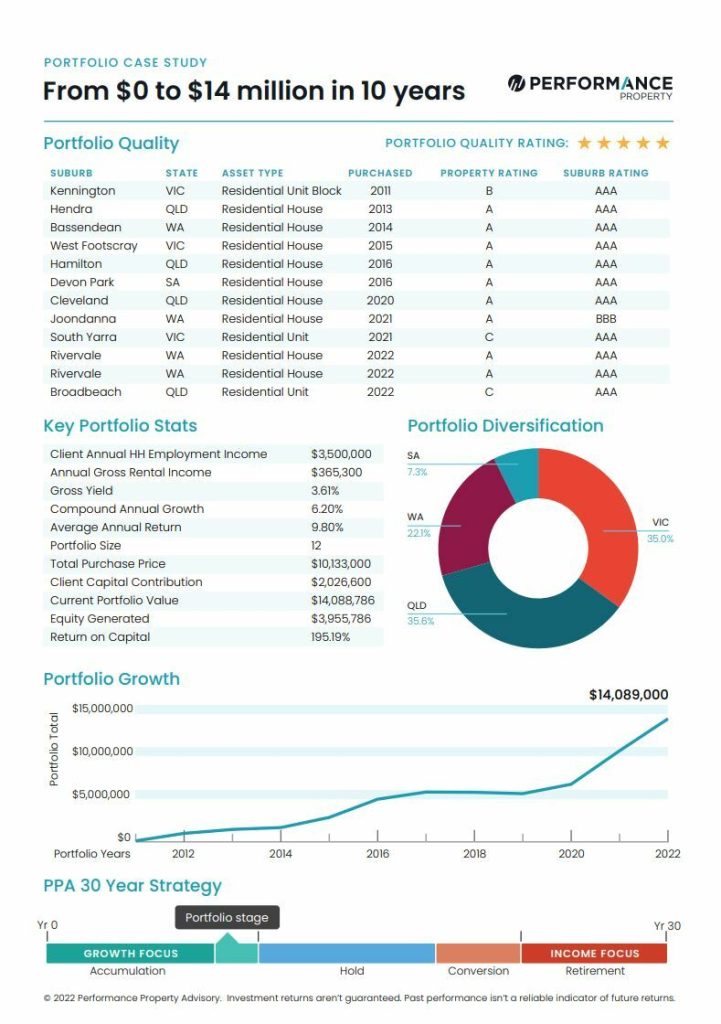

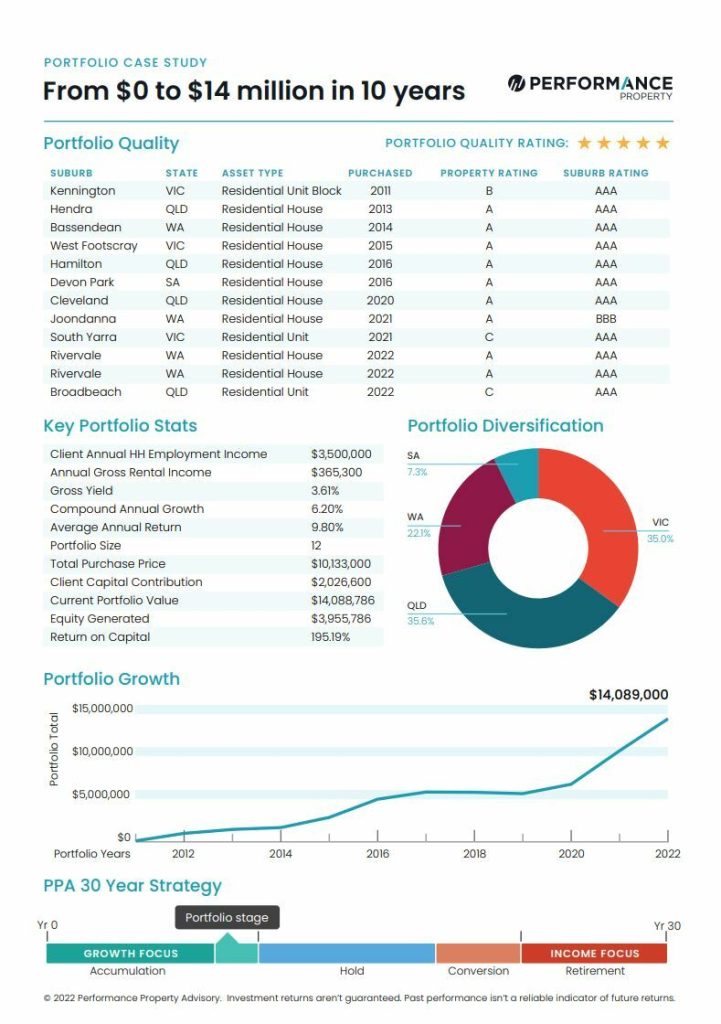

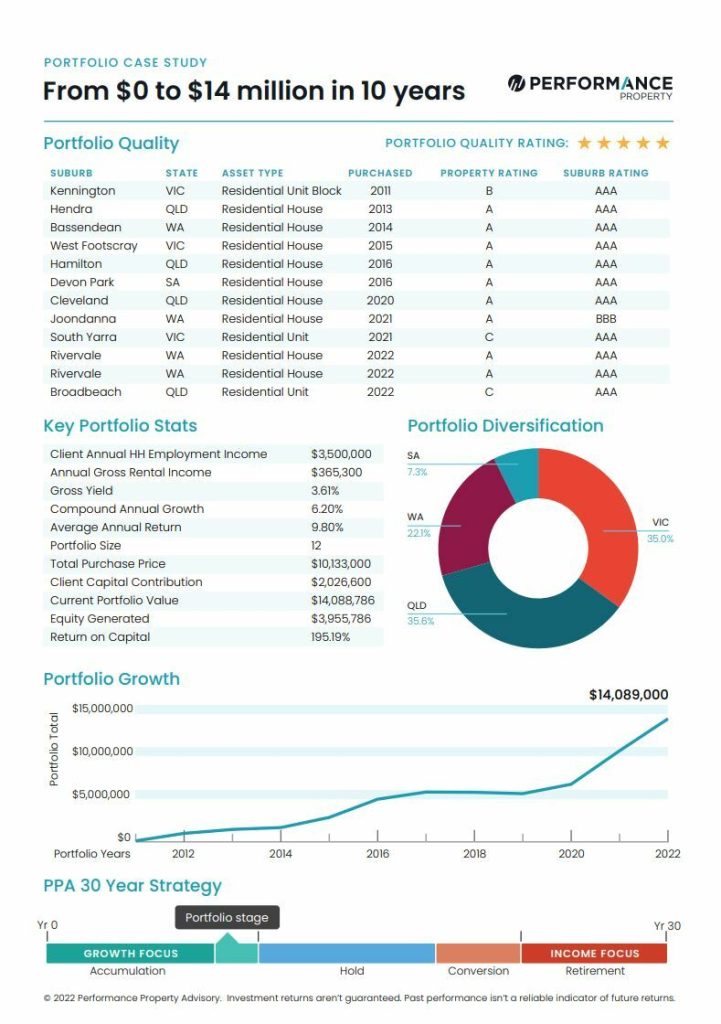

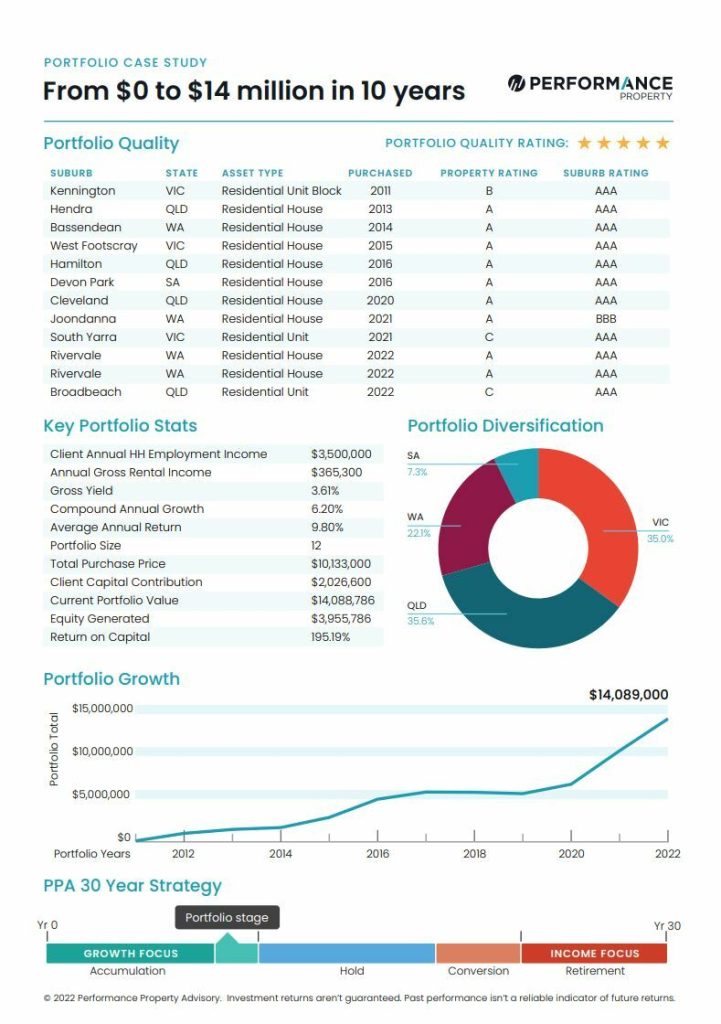

From $0 to $14 million in 10 years

Comprising 12 assets, strategically diversified across four states to reduce land tax and mitigate market risk.

Performance case studies.

Explore our selection of case studies on client portfolios that we have built over the years.

From $0 to $7 million in 6 years

A-grade capital city assets in Melbourne, Brisbane, and Adelaide.

Performance case studies.

Explore our selection of case studies on client portfolios that we have built over the years.

From $0 to $4.4 million in 8 years

A-grade established homes purchased in AAA locations in Brisbane, Adelaide, and Perth.

Performance case studies.

Explore our selection of case studies on client portfolios that we have built over the years.

From $0 to $4.8 million in 8 years

Achieving over 400% return on our client’s invested capital.

Performance case studies.

Explore our selection of case studies on client portfolios that we have built over the years.

We manage portfolio risk

Establishing and managing an extensive property portfolio provides a unique set of challenges and risks. There are variables such as rents, values, market conditions, market forecasts, interest rates and your personal financial situation which need to be considered. The complexity intensifies with the growth of assets within a portfolio. Without proper management, the risks can escalate rapidly.

Our portfolio management service is designed to simplify this process, empowering clients to effectively navigate challenges and mitigate portfolio risks.