Assistant Buyers’ Agent – Brisbane

Are you a dynamic, motivated professional eager to advance your real estate career as a Buyers’ Agent? Do you excel in roles that blend relationship building, continuous learning, and hands-on involvement in sourcing and evaluating investment properties? If so, this opportunity could be the perfect fit for you. We are a renowned property investment firm […]

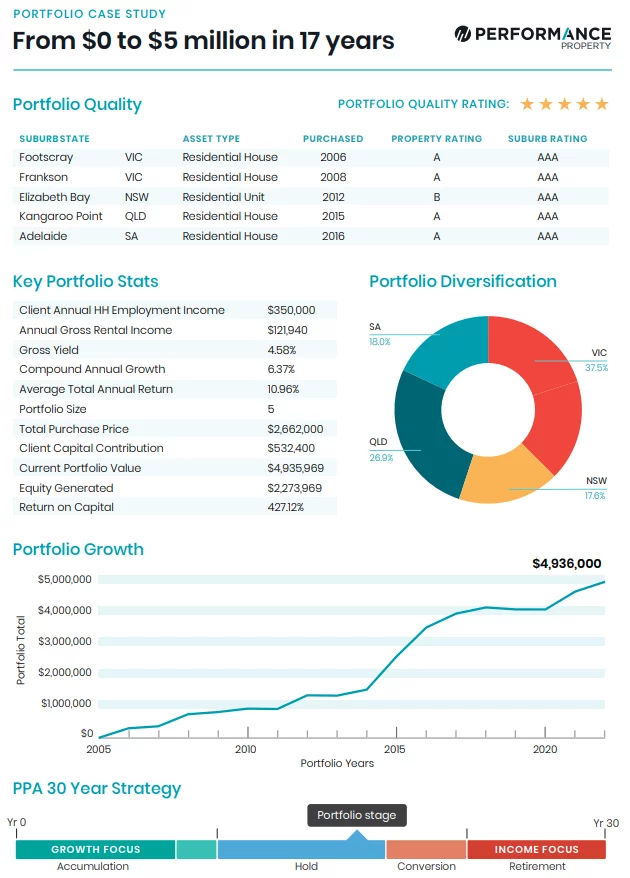

From $0 to $5 million in 17 years

This residential portfolio comprises four A-Grade established homes and a holiday apartment purchased in AAA locations between 2006 and 2016. The portfolio is diversified across four states which helps lower land tax and spreads market risk. Given the growth this portfolio has generated and the debt reduction over time, this portfolio has a very low […]

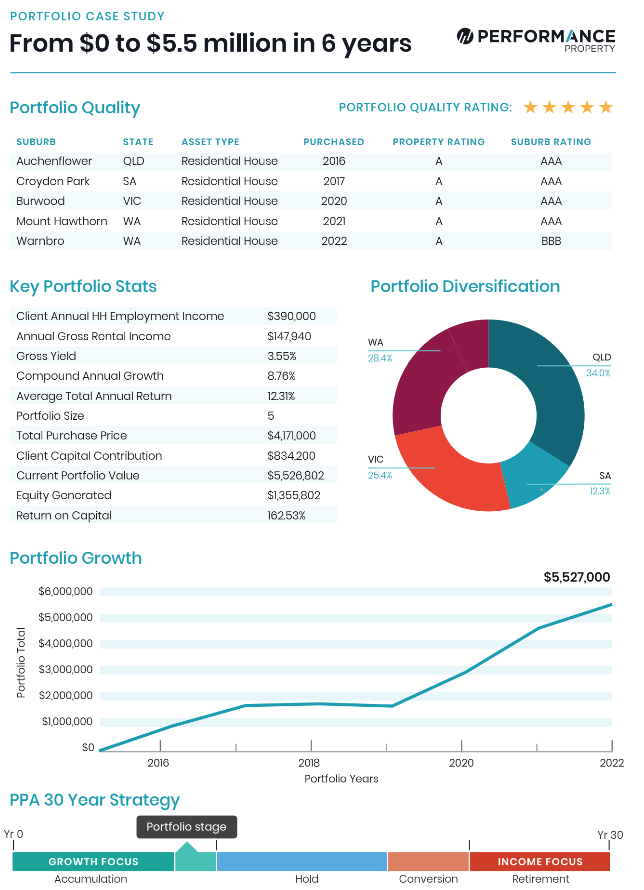

From $0 to $5.5 million in 6 years

This residential portfolio comprises five passive A-Grade established homes purchased in AAA and BBB locations between 2016 and 2022. The portfolio is diversified across four states which helps lower land tax and spreads market risk. Our client is nearing the end of the accumulation phase of their strategy. We are looking to acquire two more […]

From $0 to $6 million in 5 years

This residential portfolio comprises four A-Grade established homes purchased in AAA locations between 2017 and 2021. The portfolio is diversified across three states which helps lower land tax and spreads market risk. Our client is actively acquiring assets and we expect to grow the portfolio to seven assets before they enter the hold phase of […]

From $0 to $4.8 million in 8 years

Achieving over 400% return on our client’s invested capital. This simple residential portfolio comprises three A-Grade established homes purchased in AAA locations between 2013 and 2021. It has generated over 400% return on our clients capital invested. The portfolio is diversified across three states which helps lower land tax and spreads market risk. Our client […]

From $0 to $4.4 million in 8 years

We started compiling this Capital City focussed blue chip residential portfolio for our client in 2014. The portfolio comprises four A-Grade established homes purchased in AAA locations in Brisbane, Adelaide, and Perth. The portfolio is diversified across three states which helps lower land tax and spreads market risk. Our client is now in the hold […]

From $0 to $7 million in 6 years

We are working with our client to build out a $20m portfolio. The portfolio currently consists of a unit block in Melbourne and three A-grade capital city assets in Melbourne, Brisbane, and Adelaide. The portfolio is diversified across three states which helps lower land tax and spreads market risk. The Brisbane and Adelaide assets are […]

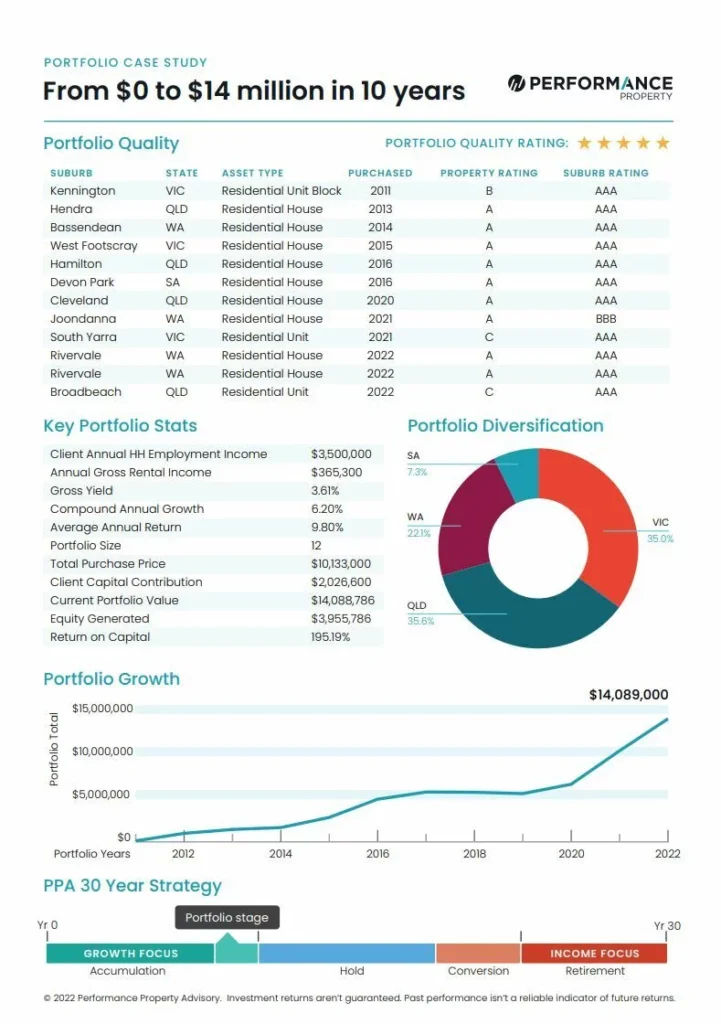

From $0 to $14 million in 10 years

We are working with our client to build out a $20m portfolio. The portfolio currently consists of a unit block in Melbourne and three A-grade capital city assets in Melbourne, Brisbane, and Adelaide. The portfolio is diversified across three states which helps lower land tax and spreads market risk. The Brisbane and Adelaide assets are […]