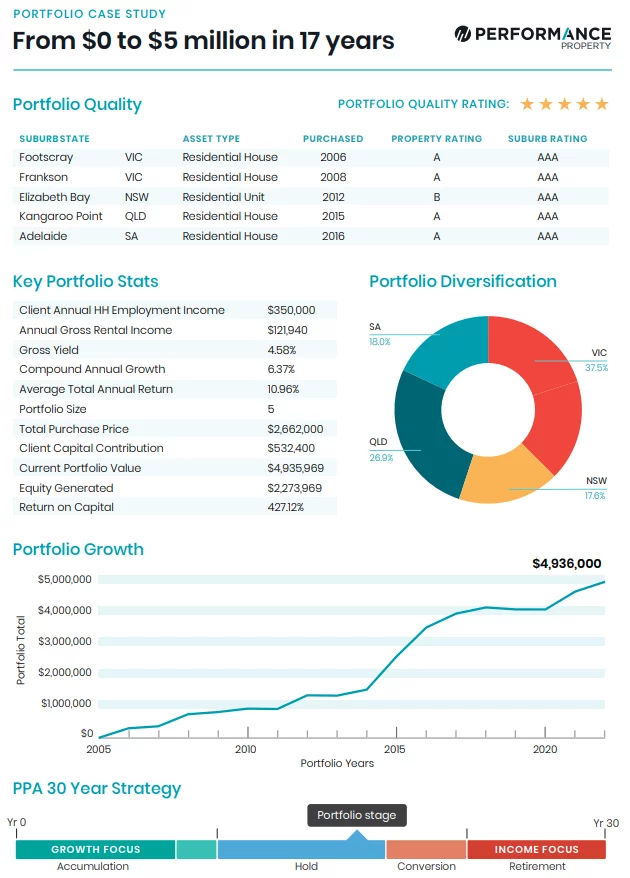

This residential portfolio comprises four A-Grade established homes and a holiday apartment purchased in AAA locations between 2006 and 2016. The portfolio is diversified across four states which helps lower land tax and spreads market risk. Given the growth this portfolio has generated and the debt reduction over time, this portfolio has a very low Loan-to-Value Ratio (LVR).

Our client is now entering the conversion phase of their strategy which we expect will last for three to five years leading into retirement. During the conversion phase, we will develop a divestment strategy which will detail the assets to sell to release equity, and options to reinvest the profit to meet our clients income goal for retirement.