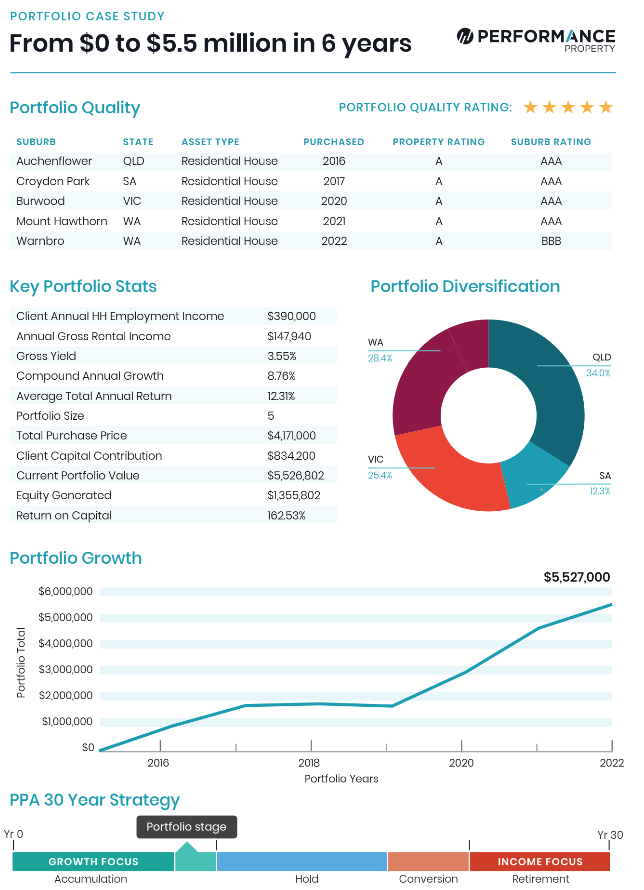

This residential portfolio comprises five passive A-Grade established homes purchased in AAA and BBB locations between 2016 and 2022. The portfolio is diversified across four states which helps lower land tax and spreads market risk. Our client is nearing the end of the accumulation phase of their strategy. We are looking to acquire two more assets over the next four years to compliment the existing portfolio, and will then hold assets and pay down debt. Our client was not interested in renovations or development, so we have developed a portfolio of passive assets that require minimal maintenance and work.

During the hold phase, we will conduct regular portfolio reviews so our client is informed about their equity. We also monitor key portfolio performance and risk metrics, including our client’s loan-to-value ratio, cash buffer, and debt-to-income ratio.